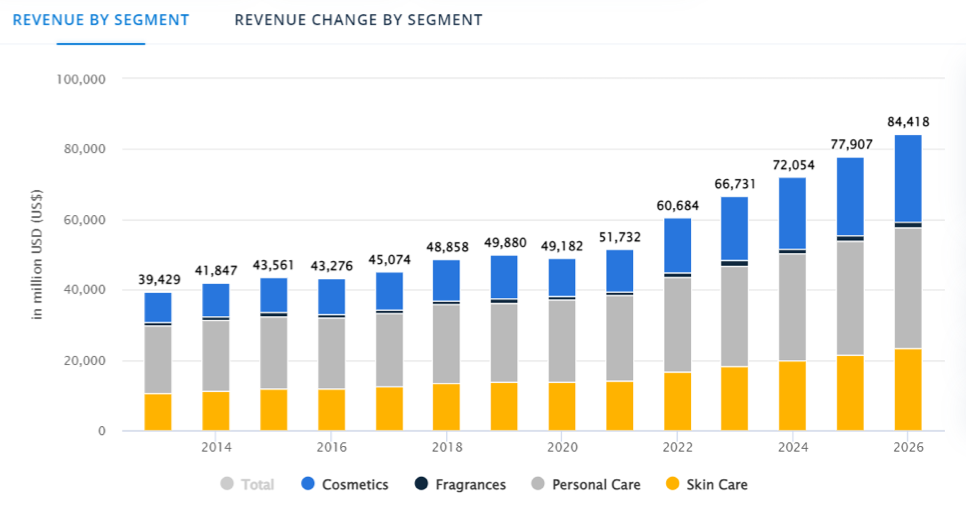

China is the second-largest cosmetic and personal care market in the world after the United States in terms of market value. The market size for China’s cosmetics and personal care industry has been steadily expanding particularly for skincare and cosmetics products. This is primarily driven by the increasing beauty consciousness, particularly among the millennial and urbanized population. Moreover, the strong economic growth especially from the generational shift, young consumers are with better disposal power and further reinforced by e-commerce, created a lasting effect on buying behavior when it comes to beauty and care products. Statista estimated that revenue amounts to approximately US$ 61 m in 2022 (17% growth from 2021). The market is expected to grow annually by 10.29% (CAGR 2021-2026).

Graph 1. Revenue by segment in China cosmetic and personal care market (Statista).

In terms of products segments for the cosmetics market, skincare products dominate the China market with almost 245 billion yuan in 2019 and are estimated to have a growth of 27% in 2021 to 311 billion yuan. China’s appetite for cosmetic products has a distinctly global flavor, where 57% of Chinese consumers preferred foreign brands over local ones (Statista). Accounting for 60% of the china skincare market share, consumers aged between 20 to 30 years old are preferred in regularly purchasing high-quality skincare products. The behavior of young consumers in China was believed to be influenced by the rise of digital skincare aficionados (such as influencers, celebrities, etc) voicing their opinions and discussing personal skincare topics and routines with their group of followers via forums, social media. This subsequently increased consumer health awareness that further fueled the routine skincare movement. In addition, with the acceleration of e-commerce in the past years, consumers have become more discerning about their online shopping experiences. China is at the forefront of on-demand deliveries combining the convenience of online shopping with the immediacy of brick-and-mortar retails. The other main traditional distribution channels for cosmetic and personal care products are supermarkets and hypermarkets. According to Statista, The top 3 criteria to consideration among Chinese consumers for skincare and cosmetic products are products effectiveness, cost, and brand guarantee.

Graph 2. Criteria to consideration among Chinese consumers for skincare and cosmetics products (Statista).

The market for palm oil

In China, palm oil was imported for the food and non-food sector. For the oleochemical industry, palm-derived ingredients form part of the formulation of emulsifiers, foam boosters, stabilizers, mildness agents, pearlized formulas, conditioners, suspensions, and thickeners, among others, which are found in product categories such as bath & shower, skincare, haircare, body care, deodorant, oral care, hygiene care, sun care, baby care, toiletries, perfumes & fragrances, and other make-up (cosmetic) merchandise.

Palm oil and palm-based oleochemical derivatives are natural palm-based emollients widely used as ingredients among the manufacturers of cosmetic and personal care products. Based on industry estimates, for example, palm oil and its derivatives are present in at least 70% of the cosmetic products produced in China.

Based on Malaysia’s export statistics of palm-based oleochemicals and palm oil, palm stearin is the main ingredient used in China’s local oleochemical production.

1. Palm Oil

Most of the palm oil products exported to China are used for the food sector such as RBD palm oil (for shortening production) and RBD palm olein (for frying). While for RBD Palm Stearin, Palm fatty acid distillate, and palm acid oil, these products are used in the non-food sector for producing basic oleochemicals, soap as well as hydrogenated vegetable oil.

Table 1: Malaysia’s Palm Oil Exports to China (MT)

| Products | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| RBD Palm Olein | 1,260,493 | 1,227,185 | 1,663,172 | 1,757,527 | 1,045,801 |

| RBD Palm Stearin | 342,974 | 298,814 | 436,199 | 587,154 | 517,138 |

| Crude Palm Stearin | 264,887 | 289,800 | 251,452 | 265,044 | 204,905 |

| RBD Palm Oil | 5,959 | 694 | 2,148 | 1,813 | 5,024 |

| Palm Acid Oil | 21,955 | 12,458 | 68,743 | 76,283 | 66,026 |

| Others | 21,019 | 30,797 | 68,788 | 42,839 | 33,971 |

| Total | 1,917,287 | 1,859,748 | 2,490,502 | 2,730,660 | 1,872,865 |

2. Palm-Based Oleochemicals

In 2021, the export of Malaysia Palm-based oleochemical products to China was decreased by 4% mainly contributed by fatty acids, -7%. However, the overall export value saw a significant jump of close to 50%. It is believed that a tight supply of vegetable oil particularly Malaysia palm oil was the main driver for the high price, yet the demand for oleochemicals is still there. During the coronavirus outbreak, the production of fatty acids in China hiked about 17% where this product was mainly used in plastics and surfactants (the ingredient in soap). A small growth of 2% in glycerine/ glycerol is imported from Malaysia into China. Generally, glycerin is used in small proportions to manufacture hand rubs and sanitizers. To further fuel the demand for glycerine, World Health Organization (WHO) released its ethanol-based hand rub formulation containing 1.45% glycerol to protect healthcare workers’ skin against dermatitis and dryness. Apart from that, glycerine is a key byproduct of the biodiesel manufacturing process, variations in biodiesel production would fluctuate the downstream prices. According to USDA, with lower domestic biodiesel production due to high feedstock prices, China has to rely on imports to meet domestic various market demands.

Table 2: Malaysia Oleochemical products exported to China (MT)

| Products | YoY growth for export (MT) | YoY growth for export value (RM mill) | Jan-Dec 2021 | Value (RM mill) | Jan- Dec 2020 | Value (RM mill) |

|---|---|---|---|---|---|---|

| Glycerine/ Glycerol | +2% | +32% | 163,000 | 678.35 | 169,000 | 513.63 |

| Fatty acids | -7% | +64% | 147,400 | 974.12 | 159,000 | 595.16 |

| Fatty alcohols | -4% | +49% | 109,200 | 805.05 | 113,500 | 541.33 |

| Others | -8% | +23% | 107,000 | 592.81 | 107,600 | 482.46 |

| Total | -4% | +48% | 526,600 | 3150.33 | 549,100 | 2132.58 |

Table 3: Production of selected Oleochemical products in China (MT)

| Products | Jan-Dec 2021 | Jan- Dec 2020 | YoY growth |

|---|---|---|---|

| Glycerine/ Glycerol | 755,400 | 735,600 | +3% |

| Fatty acids | 844,900 | 721,000 | +17% |

| Fatty alcohols | 366,900 | 397,000 | -8% |

| Total | 1,967,200 | 1,853,630 | +6% |

Challenges Related to China’s Oleochemicals Industry

1.Oleochemical raw materials generally mirrored the Brent crude oil prices movement

The glycerine market lacks interdependence between supply and demand. Its supply is often dependent on the performance of the biodiesel markets where the glycerine supply increases only when the demand for biodiesel goes up. It is difficult to predict whether the growth of the biodiesel market will go hand in hand with the increased glycerine demand, let alone to forecast the development of prices trend in both short and long-term perspectives. This will be determined solely by the development of the biodiesel industry and the legislative support for biodiesel production in countries. Furthermore, as hydrogenated vegetable oil (HVO) use grows in the EU, it is foreseeable that the glycerine output may be stagnant in the future as this will lead to a decrease in traditional biodiesel demand and therefore biodiesel production. This in turn will directly impact glycerine supply globally. Nevertheless, new applications for oleochemicals are constantly being invented. This may still result in continuously growing demand predominantly from China.

2. Strong presence of international foreign brands that only sourced for RSPO certified palm oil

Out of the top 5 cosmetics players in China, only Shanghai Pechoin, a China local brand that could compete with international brands. Among the top selling international brands for cosmetic products are L’Oréal Paris (RSPO member), Lancôme, Estée Lauder, and Olay. According to their official websites, they are committed to sourcing only RSPO palm oil for their skincare and cosmetic production. These giant cosmetics players have been strong advocates for sustainability and cruelty-free for their marketing strategies. For Malaysia palm oil to be competitive in this aspect, MSPO- certified products need to be recognized internationally. Tremendous efforts have been carried out by the Malaysia Ministry of Plantation Industries and Commodities to promote MSPO-certified palm products domestically and internationally. In conjunction with the Tokyo Games and Paralympics 2021, the Malaysian palm oil industry created history, to export fully Malaysian Sustainable Palm Oil (MSPO) certified products to Japan. This has marked an important milestone in the development of MSPO- certified products as well as in elevating the status of MSPO as a standard that would gain international recognition and acceptance.

Graph 3. China’s leading cosmetics and skincare brands 2021 (Statista).

Conclusion

With the ongoing Covid-19 battle especially in China with a zero-tolerance policy, the demand for personal care (including skincare) and sanitizing products are expected to continue thriving with a CAGR of 10.3%. The rapid growth of China’s digitalization push is one of the critical marketing strategies that allow entertaining, personalized, and educating interactive engagement with all layers of consumers. Furthermore, the growing focus on sustainability has been shining a light on the natural ingredients used by clean beauty brands. Hence, innovations in areas for palm-based oleochemical application are believed to have great potential in China’s cosmetics and personal care market.

Prepared by Lim Teck Chaii & Ho Carl Miew

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.

References:

- Fortune Business Insights (2021). Retrieved from https://www.globenewswire.com/news-release/2021/09/27/2303730/0/en/Glycerine-Market-to-Hit-USD-2-53-Billion-by-2028-Rising-Demand-for-Biodiesel-Because-of-Industrialization-to-Boost-Growth-Says-Fortune-Business-Insights.html

- Fortune Business Insights (2021). Retrieved from https://www.fortunebusinessinsights.com/glycerine-market-102168

- Fortune Business Insights (2021). Retrieved from https://www.globenewswire.com/news-release/2022/01/14/2367176/0/en/Global-Fatty-Esters-Market-to-Reach-US-2-5-Billion-by-the-Year-2026.html

- USDA (2021). China: Biofuel Annual Retrieved from https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Biofuels%20Annual_Beijing_China%20-%20People%27s%20Republic%20of_08-16-2021.pdf

- Greenea (2015). Glycerine market: lack of interdependence between supply and demand. Retrieved from http://www.greenea.com/publication/glycerine-market-lack-of-interdependence-between-supply-and-demand/

- Statista. Retrieved from https://www.statista.com/outlook/cmo/beauty-personal-care/china

- Malaysia’s maiden export of MSPO- certified palm oil makes its way to Japan (2021). Retrieved from https://www.nst.com.my/business/2021/05/690685/malaysias-maiden-export-mspo-certified-palm-oil-makes-way-japan

- Cosmetics design-asia.com: Revealed 5 key beauty and personal care trends set to shape the industry in 2022 (2022). Retrieved from https://www.cosmeticsdesign-asia.com/Article/2022/01/04/Revealed-Five-key-beauty-and-personal-care-trends-set-to-shape-the-industry-in-2022